The debate over healthcare payments in the United States has been ongoing for years, and it has become even more critical in the midst of the COVID-19 pandemic. As millions of Americans are expected to require hospitalization due to the virus, the U.S. healthcare system faces unprecedented challenges. In response, Congress has passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which includes $100 billion in assistance for hospitals and other healthcare providers. However, concerns have been raised about whether even the increased Medicare rates provided by the CARES Act would be sufficient.

To shed light on this issue, we turn to a recent issue brief that reviews 19 studies comparing Medicare and private health insurance payment rates for hospital care and physician services. The findings of these studies provide insight into the payment disparities and the potential impact on healthcare costs and accessibility.

Key Findings

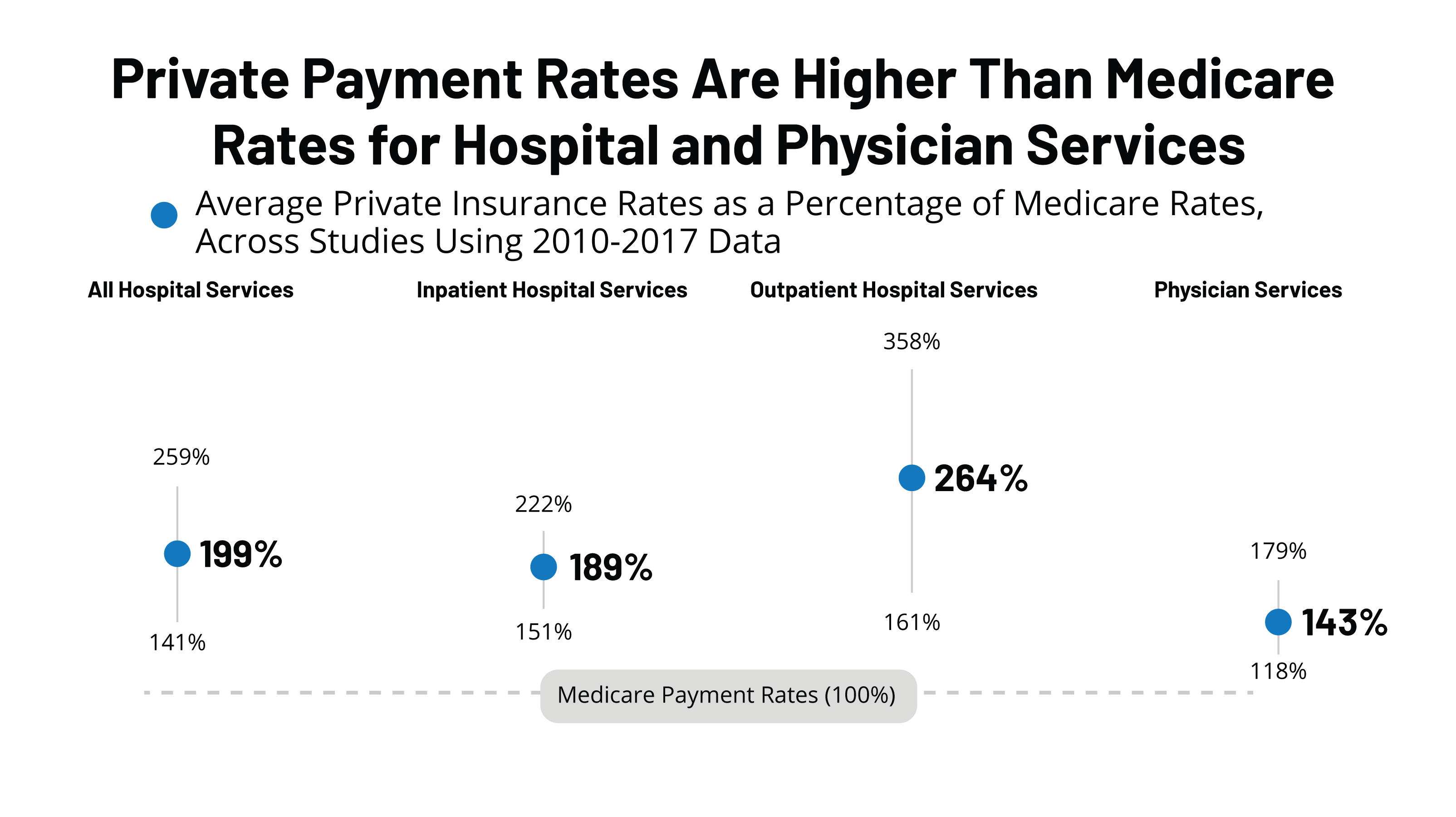

According to the review, private insurers pay nearly double the rates of Medicare for all hospital services, averaging around 199% of Medicare rates. The difference between private and Medicare rates is even more pronounced for outpatient hospital services, where private insurers pay an average of 264% of Medicare rates compared to 189% for inpatient hospital services. For physician services, private insurance payments average 143% of Medicare rates.

It is important to note that these payment disparities vary across studies due to several factors, including the representativeness of the hospitals, physicians, and insurers analyzed, data collection periods, and market characteristics. However, the overall trend remains consistent: payments from private insurers are significantly higher than Medicare payments for both hospitals and physicians.

Implications for Healthcare Costs and Access

The payment disparities between private insurers and Medicare raise important questions about healthcare costs and accessibility. While proponents argue that higher payments from private payers are necessary to compensate for lower Medicare payments, critics argue that these disparities contribute to the high costs of healthcare in the U.S. and hinder efforts to reduce national health spending.

If provider payments were brought closer to Medicare levels, providers would have stronger incentives to become more efficient, potentially lowering healthcare costs for patients and employers. However, it is essential to consider the financial viability of providers, as some efficient providers have reported losses on Medicare patients in recent years. The transition to lower payments would require careful planning and assessment to ensure the quality and accessibility of care are not compromised.

The Role of Medicare in Health Reform Proposals

Given the payment disparities between private insurers and Medicare, policymakers are increasingly considering the role of Medicare in broader health reform proposals. Several recent proposals aim to expand coverage and reduce healthcare spending by aligning provider payments more closely with Medicare rates. These proposals include Medicare-for-All, public option plans, and state rate-setting initiatives.

By adopting Medicare rates or a multiplier of Medicare rates, these proposals could make coverage more affordable, reduce out-of-pocket costs for patients, and generate savings for employers. However, the potential financial strain on providers must also be carefully considered. The impact of these proposals would vary depending on the magnitude of the payment gap between private insurers and Medicare, as well as the ability of providers to adapt and operate more efficiently.

Conclusion

The payment disparities between private insurers and Medicare highlight the complexities of the U.S. healthcare system and the ongoing debate over healthcare costs and accessibility. While private insurers currently play a dominant role, proposals to align payments with Medicare rates could have significant implications for providers, patients, and employers.

As policymakers navigate these challenges, it is crucial to strike a balance between controlling healthcare costs and ensuring the financial viability of healthcare providers. The findings of the reviewed studies provide valuable insights into the payment disparities and underscore the need for further research and discussion to inform meaningful healthcare reform.

FAQs

-

Q: How do private insurers’ payment rates compare to Medicare rates?

- A: Private insurers pay nearly double the rates of Medicare for all hospital services, averaging around 199% of Medicare rates. For outpatient hospital services, private insurers pay an average of 264% of Medicare rates, while for physician services, the average private insurance payment is 143% of Medicare rates.

-

Q: What are the implications of the payment disparities between private insurers and Medicare?

- A: The payment disparities raise important questions about healthcare costs and accessibility. Aligning private insurer payments with Medicare rates could incentivize providers to become more efficient and potentially lower healthcare costs. However, the financial viability of providers must also be considered to ensure the quality and accessibility of care are not compromised.

-

Q: How do health reform proposals address the payment disparities?

- A: Some health reform proposals, such as Medicare-for-All and public option plans, aim to align provider payments more closely with Medicare rates. These proposals could make coverage more affordable, reduce out-of-pocket costs for patients, and generate savings for employers. However, the potential impact on providers and their ability to adapt to lower payments must be carefully considered.

-

Q: What are the challenges in addressing the payment disparities?

- A: Balancing healthcare costs and the financial viability of providers is a complex challenge. Efforts to bring payments closer to Medicare rates should be accompanied by careful planning and assessment to ensure the quality and accessibility of care. Additionally, the ability of providers to adapt to lower payments and operate more efficiently may vary, requiring a transition period and comprehensive evaluation.

-

Q: What does this mean for the future of healthcare in the U.S.?

- A: The payment disparities between private insurers and Medicare highlight the need for comprehensive healthcare reform. Balancing costs, accessibility, and the financial viability of providers is crucial. Further research and discussions are needed to inform policies that can lead to a more sustainable and affordable healthcare system.

Sources:

News Explorer Today