The Fair Credit Reporting Act (FCRA) ensures that consumers have access to their credit reports for free. According to federal law, each of the three credit bureaus is required to provide consumers with one free credit report per year. Additionally, consumers are entitled to free credit reports if they have experienced adverse actions, such as credit denial, insurance or employment denial, or reports from collection agencies or judgments. However, it’s important to note that consumers must request the report within 60 days of the adverse action occurring.

In certain circumstances, specific groups of individuals are also eligible for free credit reports. This includes individuals who are on welfare, those who are unemployed and planning to seek employment within 60 days, and victims of identity theft.

Getting Free Credit Reports under the FCRA

To obtain your free credit reports, the three major credit bureaus have established a central website and a mailing address. You can choose to receive all three reports at once or request them individually – the law allows you to order one free copy of your report from each credit bureau every 12 months.

To access your free reports, visit AnnualCreditReport.com. Alternatively, you can complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

Warning about “Impostor” Websites Offering Free Credit Reports

It is crucial to be cautious when seeking free credit reports online. Only one website is authorized to fulfill orders for the free annual credit report mandated by law: AnnualCreditReport.com. Other websites that claim to offer “free credit reports,” “free credit scores,” or “free credit monitoring” are not part of the legally-mandated free annual credit report program.

Some of these “impostor” websites may have hidden terms and conditions. For instance, they may sign you up for a supposedly “free” service that converts into a paid subscription after a trial period. If you fail to cancel during the trial period, you may unintentionally agree to allow the company to charge fees to your credit card.

These “impostor” sites often use names similar to “free report” or intentionally misspell the official AnnualCreditReport.com URL. Their goal is to misdirect consumers to sites that either sell products or collect personal information.

It’s important to note that AnnualCreditReport.com and the nationwide credit reporting companies will never send you an email requesting your personal information. If you receive an email, encounter a pop-up ad, or receive a phone call from someone claiming to represent AnnualCreditReport.com or any of the three nationwide credit reporting companies, do not respond or click on any links. These are likely scams. To ensure you are on the correct website, verify through the Consumer Financial Protection Bureau (CFPB).

Do Free Credit Reports Include FICO® Scores?

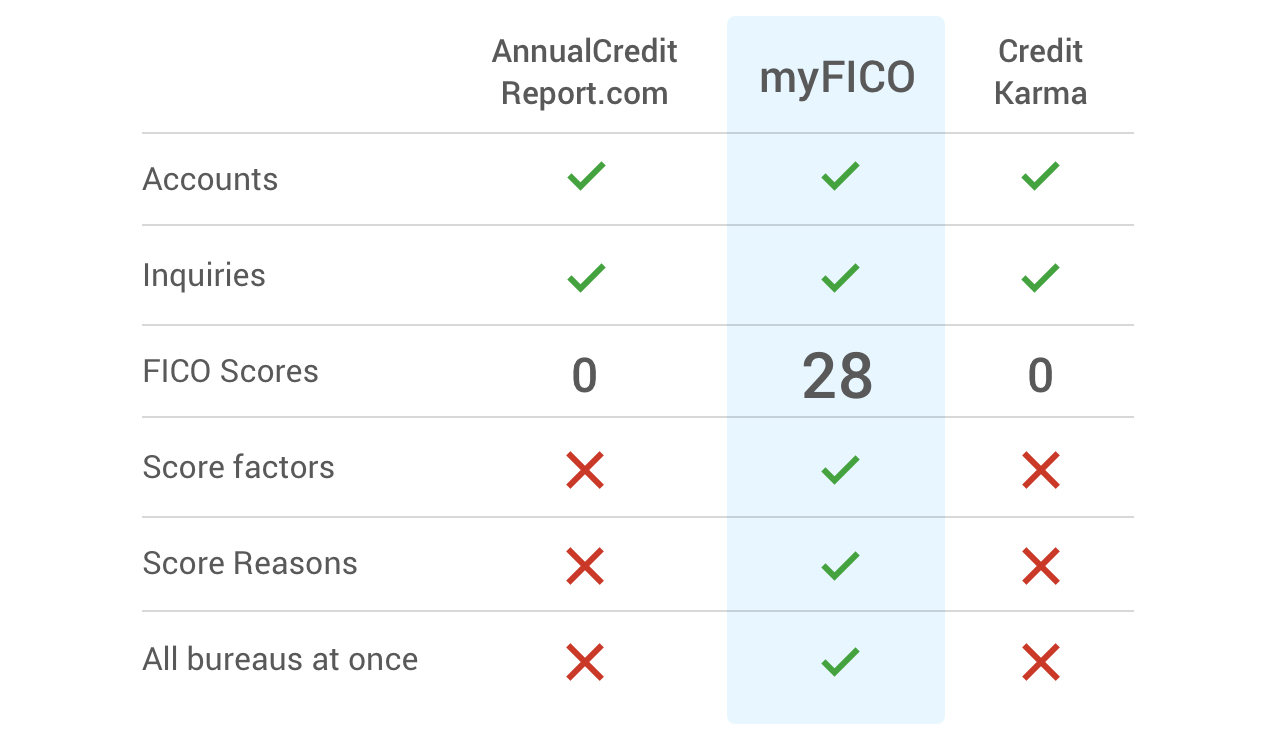

The free credit reports provided by AnnualCreditReport.com do not include your FICO® Scores. If you would like to know your FICO Scores, you can find more information on where to obtain them.

FAQs

Q: How often can I request a free credit report?

A: According to the FCRA, you are entitled to one free credit report from each of the three credit bureaus every 12 months. You can request them all at once or stagger them throughout the year.

Q: Are there any circumstances where I can receive additional free credit reports?

A: Yes, there are certain circumstances where individuals may be eligible for additional free credit reports. These include being on welfare, being unemployed and planning to seek employment within 60 days, and being a victim of identity theft.

Conclusion

Accessing your credit reports is an essential step in understanding your financial standing and maintaining financial health. By utilizing the resources provided by AnnualCreditReport.com, you can obtain your free credit reports from each of the three major credit bureaus. Remember to be mindful of “impostor” websites and always verify that you are on the official site to protect yourself from scams. Stay informed about your credit and take control of your financial well-being.